OEM Leaders Shine in FADA’s 2024 Dealer Satisfaction Study Amid Industry Concerns

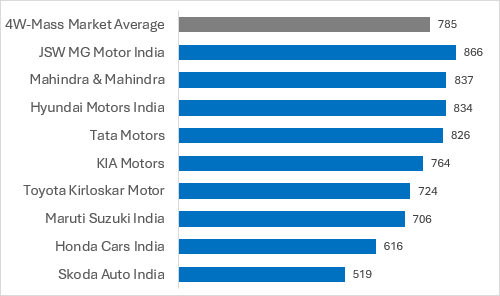

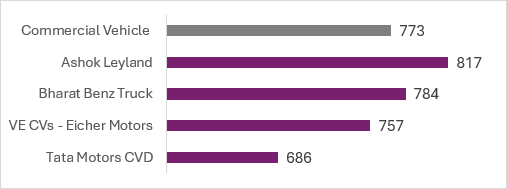

New Delhi, September 16, 2024 – The Federation of Automobile Dealers Associations (FADA) has released the highly anticipated results of its 2024 Dealer Satisfaction Study (DSS), conducted in partnership with PremonAsia, a leading consulting firm. The study revealed the top-performing original equipment manufacturers (OEMs) across key automotive segments, with JSW MG Motor, Honda Motorcycle & Scooter India (HMSI), and Ashok Leyland capturing the highest dealer satisfaction scores in the mass market 4-wheeler, 2-wheeler, and commercial vehicle categories, respectively.

Despite the celebration of top performers, the study underscored significant challenges faced by dealers, particularly related to after-sales support and business viability. These areas continue to be the most pressing concerns raised by dealers across all segments.

Key Performers in 2024

In the mass market 4-wheeler segment, JSW MG Motor outperformed its competitors with an impressive score of 866 points, topping the charts across all segments. In the 2-wheeler market, Honda Motorcycle & Scooter India (HMSI) retained its crown with 805 points, marking its fourth consecutive year at the top. Ashok Leyland also made significant strides, achieving a leading score of 817 points in the commercial vehicle segment, while Bharat Benz made its debut in the top three with a notable 94-point improvement over last year.

Persistent Dealer Concerns

FADA President Mr. C. S. Vigneshwar expressed gratitude to the 1,500 dealer principals who participated in the study, representing nearly 4,500 outlets across India. He emphasized that the feedback highlights the ongoing need for collaboration between OEMs and dealers to address critical issues such as buy-back policies for unsold spare parts and the implementation of more dealer-friendly inventory management practices.

“The 2024 results show that while dealers appreciate the reliability and diversity of OEM products, there is much room for improvement in ensuring financial stability for dealerships,” Vigneshwar noted.

After-Sales and Business Viability Dominate Concerns

PremonAsia COO Mr. Rahul Sharma echoed these sentiments, noting that despite improvements, concerns surrounding dealer viability remain widespread. Key issues include OEMs’ reluctance to adopt buy-back policies for deadstock and inadequate attention to dealers’ cost structures. “Addressing these concerns by involving dealers in policy-making could significantly improve dealer satisfaction and sustainability,” Sharma said.

Opportunities for Industry Growth

The study also highlighted several opportunities for OEMs to enhance dealer relationships, including support for clearing aged vehicle stock and increasing warranty labor rates to improve workshop margins.

Segment-Specific Insights

- 4-Wheeler Mass Market: Dealers expressed concerns about the lack of support for unsold spare parts and stock in transit, but praised OEMs for product reliability and extended warranties.

- Commercial Vehicles: Dealers sought better sales margins and long-term profitability but were satisfied with the quality of fully built vehicles and OEM responsiveness.

- 2-Wheeler Market: OEMs were criticized for their handling of deadstock and reluctance to involve dealers in policy decisions, though they earned praise for warranty claims processes and product reliability.

Overall Dealer Satisfaction Trends

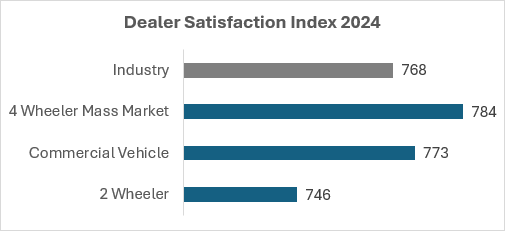

With an industry average score of 768, there was only a marginal improvement of one point from last year. While satisfaction with products remains high across all categories, business viability remains the lowest-scoring factor, even though it has seen improvements over the past two years.

Despite the challenges, the 2024 DSS report reflects a resilient and evolving automotive industry, with room for growth through enhanced dealer-OEM collaboration.